tax shield formula excel

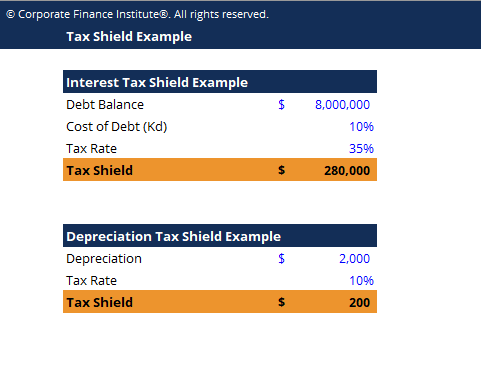

Of 2000 and the rate of tax is set at 10 the tax savings for the period is 200. A tax shield is a reduction in taxable income for an individual or corporation.

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

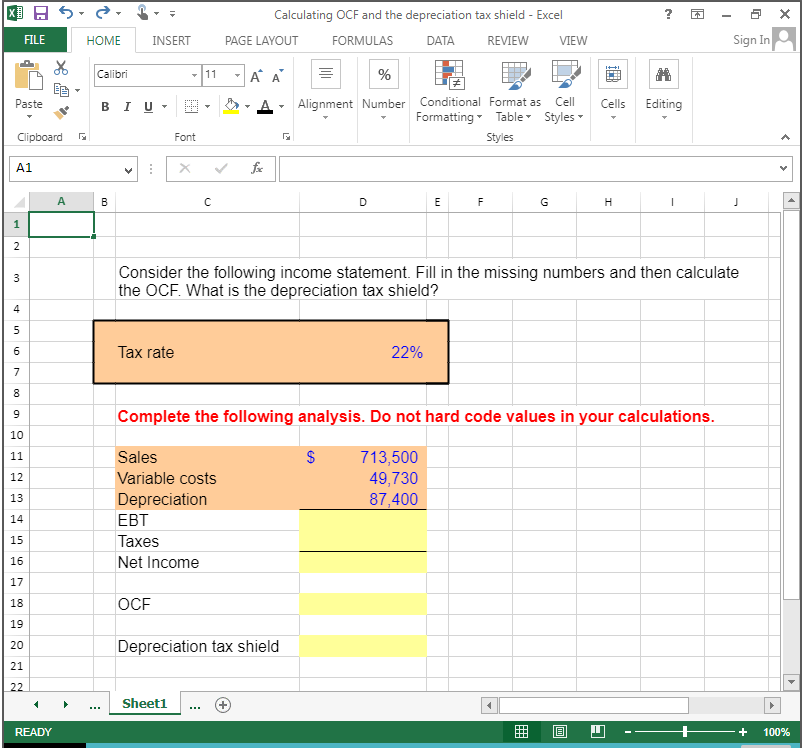

Depreciation Tax Shield Depreciation Expense Tax Rate.

. Tax Shield Notice in the Weighted Average Cost of Capital WACC formula above that the cost of debt is adjusted lower to reflect the companys. However adding back the protection is not straightforward because we need to consider the net effect of losing a tax shield. Yield Function in Excel.

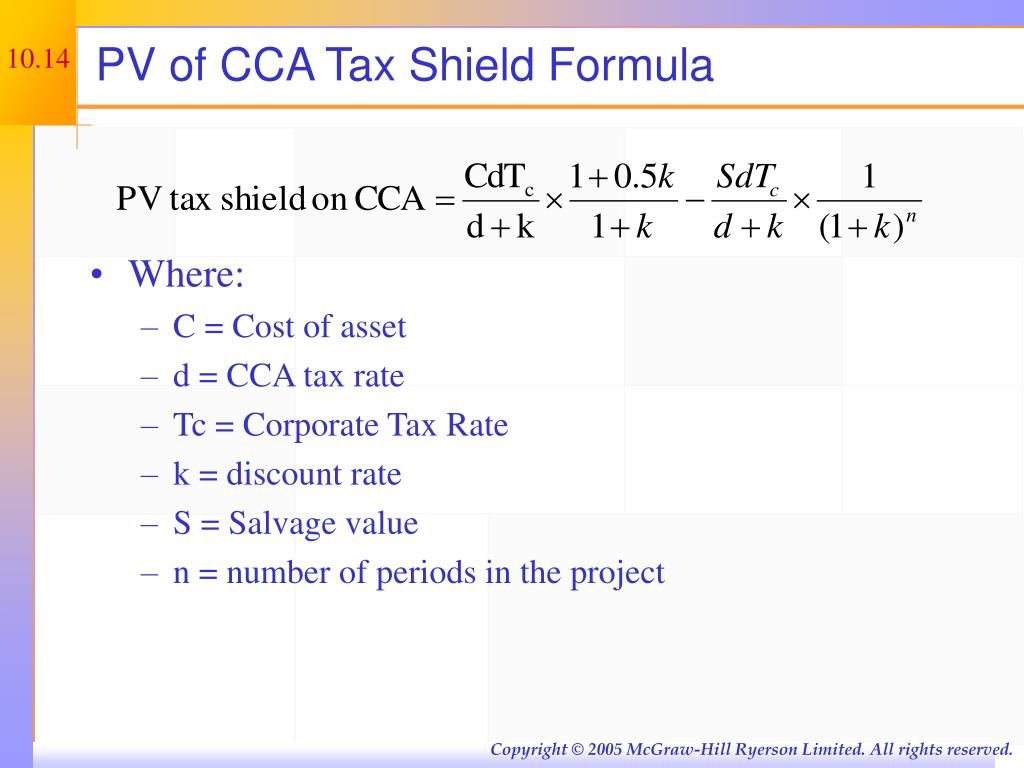

How to calculate tax shield due to depreciation. PV of CCA Tax Shield FormulaWhereI Total Capital Investmentd CCA tax rateTc Corporate Tax Ratek discount rateSn Salvage value in year nn number of periods in. And this net effect is the loss of the tax shield.

What is tax shield in WACC. Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒. Tax shield formula excel.

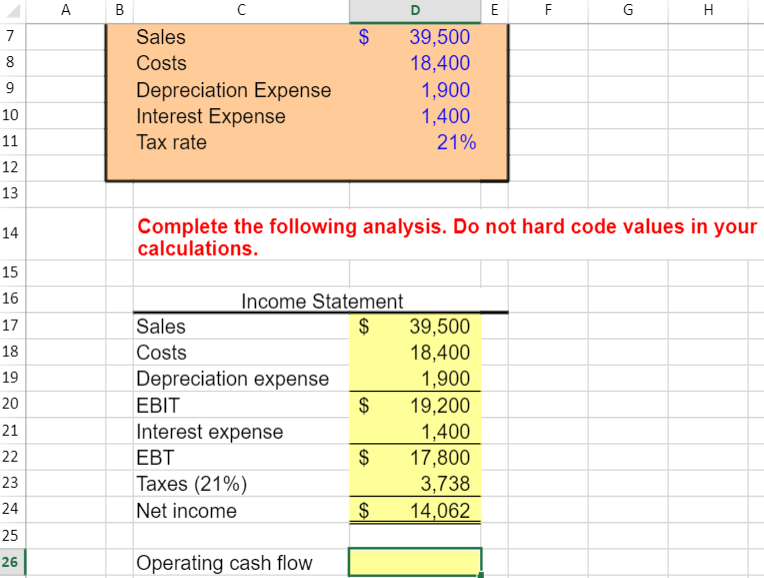

For instance if the tax rate is 210 and the. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. Monday May 23 2022.

In this video on Tax Shield we are going to learn what is tax shield. If feasible annual depreciation expense can be manually calculated by subtracting the salvage. FREE INVESTMENT BANKING COURSE Learn the foundation of Investment banking financial.

As such the shield is 8000000 x 10 x 35 280000. Tax shield formula excel. How to calculate NPV.

Interest Tax Shield Formula. For more complex models wed recommend using the MIN. For depreciation an accelerated depreciation method will also allocate more.

The interest tax shield can be calculated by multiplying the interest amount by the tax rate. FREE INVESTMENT BANKING COURSE Learn the foundation of Investment banking financial modeling valuations. Interest Tax Shield Interest Expense Tax Rate.

Yield Function in Excel. Depreciation Tax Shield Formula. Depreciation Tax Shield Formula.

In the line for the initial cost. How to calculate after tax salvage valueCORRECTION. Interest Tax Shield Formula.

PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new asset acquired after November 20 2018 𝐶𝑑𝑇 𝑑𝑘 115𝑘 1𝑘 Notation for. The formula for calculating the interest tax shield is as follows.

Tax Shield Formula Step By Step Calculation With Examples

Solved Kus म X Calculating Ocf And The Depreciation Tax Chegg Com

Tax Shields Financial Expenses And Losses Carried Forward

Tax Shields Financial Expenses And Losses Carried Forward

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

The Tax Shield Approach Assuming That The Capital Chegg Com

Income Tax Formula Excel University

Tax Shields Financial Expenses And Losses Carried Forward

Interest Tax Shield Formula And Calculator Step By Step

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Using Apv A Better Tool For Valuing Operations

Depreciation Tax Shield Formula And Calculator Step By Step

Cca Tax Shield Formula Pdf Public Finance Taxation

The Tax Shield Approach Assuming That The Capital Chegg Com

Tax Shield Example Template Download Free Excel Template

Ppt Making Capital Investment Decisions Powerpoint Presentation Free Download Id 3750664

Solved All Values Must Be Entered As An Excel Formula Chegg Com